Superneighbor

CHALLENGE:

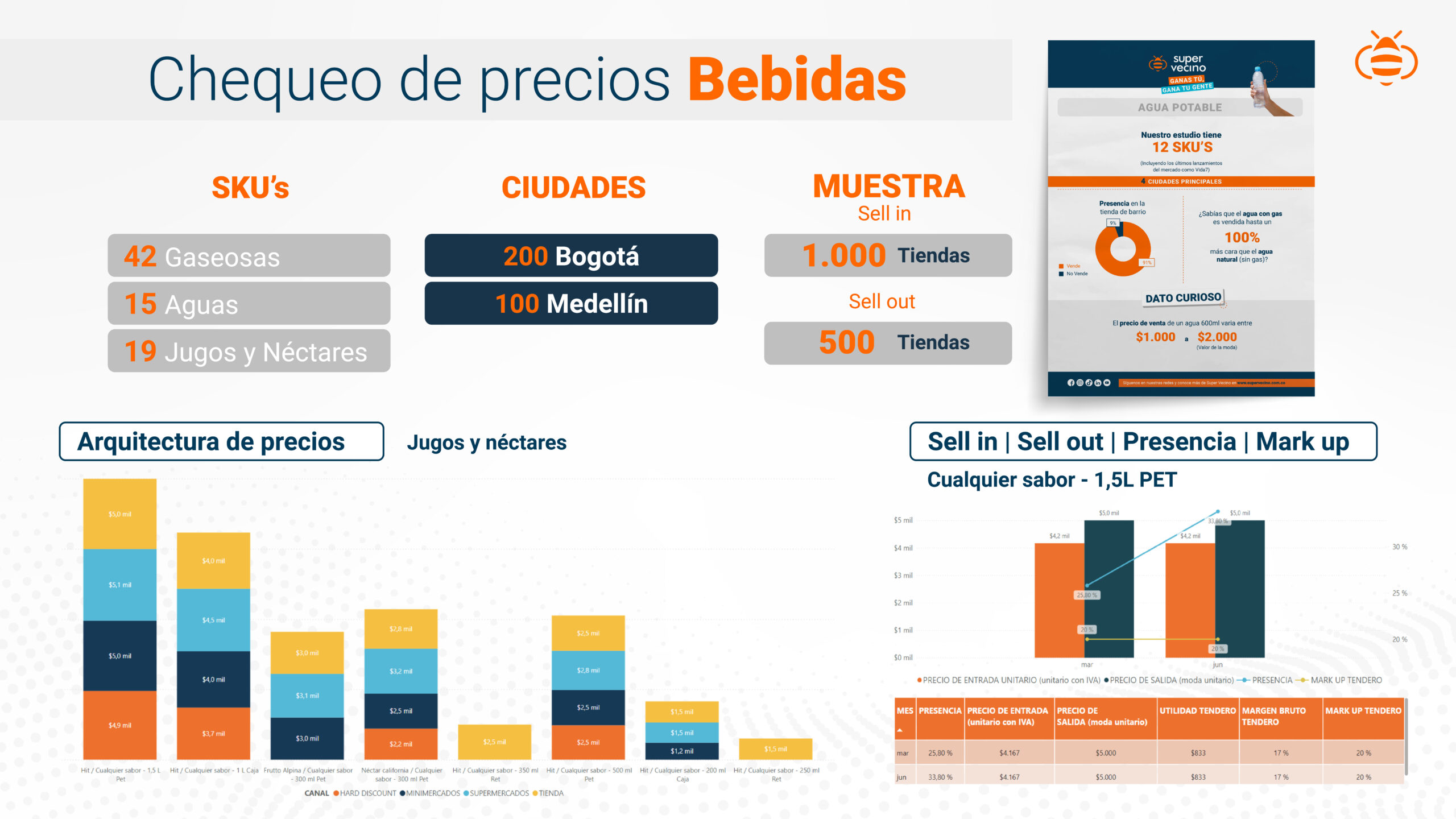

The implementation of the tax on sugar-sweetened beverages and ultra-processed foods created chaos in the prices of traditional trade, particularly

in neighborhood stores. Several brands needed to understand how their competitors were handling this new tax: whether they were reflecting it in retail prices or absorbing the increase. Uncertainty about the market response was high, similar to what happened with the introduction of the VAT, with brands having different strategies to manage the impact on prices.

SOLUTION:

Inmov developed the "Supervecinos" initiative, a platform that allowed surveys and challenges related to entry and exit prices in neighborhood stores. Shopkeepers were able to show with photos how the new tax was reflected and what its impact was on the retail price. A continuous price check was implemented, which allowed manufacturers to obtain a quick and accurate response on the implementation of the tax by their competitors.

RESULTS:

In less than 15 days, several leading manufacturers in beverage, snack, dessert, confectionery, deli meats and cookie categories gained a clear picture of how their competitors were handling the new tax.

More than 500 businesses in four major Colombian cities (Bogota, Medellin, Cali and Barranquilla), representing 50% of national GDP, were analyzed.

The Supervecinos platform provided precise data on which manufacturers were raising prices and which were temporarily absorbing the tax.

This study became a continuous monitoring of entry and exit prices and gross margin of the retail channel in Colombia, providing a valuable tool for strategic decision making.

Thanks to Supervecinos, brands were able to adjust their strategies quickly, remaining competitive and securing their position in the market.